Introduction

The financial services sector is undergoing a paradigm shift, with artificial intelligence (AI) emerging as the key catalyst behind new levels of personalization in banking and investment management. By 2023, firms in this sector invested $35 billion in AI, positioning finance among the most AI-driven sectors globally. This substantial investment reflects more than just exploring new ideas; it points to a major strategic shift for the industry.

Banks, insurance firms, and asset managers are moving beyond simply testing AI. They are now integrating it into their main operations to improve customer service, increase efficiency, and fuel business growth. Currently, over two-thirds of industry leaders see AI as more than just a tool; they view it as a future revenue source that allows them to provide more intelligent, faster, and personalized services.

At the forefront of this transformation are “AI agents”—including chatbots, virtual assistants, and automated advisory platforms—that are reshaping customer interactions across retail banking and wealth management. This article looks at how AI agents are reshaping the financial landscape—what’s working, what’s next, and what the data says.

AI Adoption and Investment Momentum

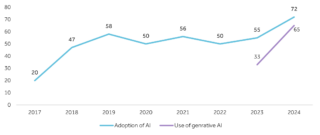

AI adoption is rapidly expanding across industries, driven by major advancements in generative AI and the growing urgency for digital transformation. Organizations are seeing AI’s potential to boost efficiency, cut costs, and discover new ways to create value, leading to an increase in AI adoption worldwide.

Figure 1: Organizations that have Adopted AI in at least 1 Business Function, % of Respondents

Source: McKinsey

Source: McKinsey

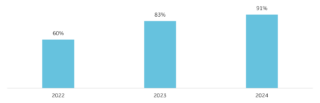

The growth of AI adoption is particularly noticeable in financial services. According to McKinsey’s “State of AI Global Survey”, approximately 60% of financial institutions had deployed AI into their operations by 2022, this figure climbed sharply to 91% by 2024.

Figure 2: Personal Experience with Generative AI Tools in the Finance Industry

Source: Fluid AI

Source: Fluid AI

Investment in AI reflects this growth. Projections show that spending on AI in financial services is expected to increase from $35 billion in 2023 to nearly $97 billion by 2027. Banks are already seeing major returns on investment, with AI-driven automation saving an estimated $7.3 billion in operational costs in 2023 alone, up from just $209 million in 2019. A study by Juniper Research estimated that chatbots helped banks save approximately 826 million hours in 2023 by automating customer interactions, freeing employees to focus on higher-value tasks.

Beyond cost savings, AI is increasingly seen as a strategic asset to boost service quality, drive growth, and enhance customer experiences. With 84% of financial institutions implementing AI governance frameworks and 90% prioritizing workforce reskilling, the sector is moving from experimentation toward responsible, large-scale integration. Financial institutions are now positioning AI as a core business capability rather than a side project, balancing innovation with a focus on trust, ethics, and long-term value creation.

AI Agents in Personalized Banking

In retail banking, AI agents like chatbots and virtual assistants have become essential for delivering personalized, on-demand services through mobile apps, websites, and messaging platforms. These AI tools, powered by Natural Language Processing (NLP) and Machine Learning (ML), can now handle routine banking tasks instantly and conversationally. Bank of America’s Erica, for instance, has managed over 2.5 billion client interactions by early 2025 and serves 20 million users, offering services from balance checks to personalized financial advice.

Modern AI agents not only respond to queries but also analyze customer data to proactively suggest savings plans, better account options, or tailored financial tips. Despite these advances, only 21% of customers currently feel fully satisfied with their bank’s personalization efforts, according to Salesforce’s Connected Financial Services Report, signaling a major opportunity for banks to close the gap. By combining rich transaction data with intelligent recommendations, AI agents are poised to deliver truly personalized banking experiences at scale.

Case Study: DBS Bank- Personalized Customer Service at Scale

A large bank that successfully leveraged AI for personalization is DBS Bank in Singapore with their “digibot” virtual assistant. The AI chatbot handles thousands of customer queries daily ranging from simple balance inquiries to complex credit card issues, in both English and regional languages. It uses NLP to understand slang and regional phrasing, making interactions feel natural. Over time, the AI learns a customer’s preferences – for example, always providing account information in a certain format – and tailors its responses. According to DBS, this has led to higher customer satisfaction and significant cost savings. While the industry as a whole still faces a personalization gap, leading examples like this demonstrate how AI agents can elevate the customer experience when thoughtfully implemented.

AI in Wealth and Investment Management

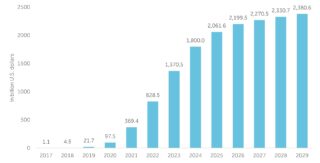

AI agents are equally transformative in the wealth management and investment domain. Robo-advisors have made investing more accessible, delivering personalized portfolio management at a fraction of the cost of traditional advisors. The growth of robo-advisory services has been striking with global assets under management (AUM) by robo-advisors surging from $97.54 billion in 2020 to a projected $2.06 trillion by 2025, driven by greater trust in automation and the rise of hybrid models that combine AI with human expertise.

Figure 3: Global Value of AuM in the Robo-Advisors Segment of the Wealth Management Market from 2017 to 2029

Source: Statista

Source: Statista

Traditional financial institutions like Vanguard and Schwab are expanding into hybrid advisory models that combine automated investing with access to human advisors. Beyond stand-alone robo platforms, AI is empowering human financial advisors by augmenting their advice with data-driven insights, helping advisors deliver faster, more informed recommendations. Robo-advisors are expanding beyond basic investing, offering features like goal-based planning, dynamic optimization, and ESG-tailored portfolios. Adoption is accelerating, and Deloitte forecasts that AI-driven tools will become the primary source of financial advice for 78% of retail investors by 2028.

Case Study: Morgan Stanley – AI Empowering Human Advisors

In 2023, Morgan Stanley launched the AI @ Morgan Stanley Assistant, a generative AI tool developed with OpenAI that allows 16,000 financial advisors to query the firm’s extensive research library using natural language, instantly retrieving tailored insights to enhance client recommendations. In 2024, the firm introduced AI @ Morgan Stanley Debrief, an AI application that automatically transcribes client meetings, summarizes key points, identifies action items, and drafts follow-up notes to streamline advisor workflows. Together, these AI tools show how Morgan Stanley is transforming wealth management by positioning AI as a strategic copilot—boosting efficiency, enriching client interactions, and empowering human advisors rather than replacing them.

Customer Expectations and Trust

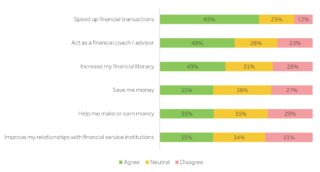

AI-driven services in finance are rising alongside evolving consumer expectations for personalization, speed, and proactive advice. While 84% of consumers want their bank to act as a trusted advisor rather than just a transaction processor, only about one in five feel fully satisfied with current personalization efforts.

A recent study by Salesforce showed that 31% of customers already view AI as a standard part of financial services, with 76% expecting its influence to grow by 2030, particularly among younger, tech-savvy generations. Top expectations include faster transactions, enhanced financial literacy, and fraud detection, though many customers still prefer human oversight for complex decisions. Trust remains a critical factor: only 47% of consumers feel they understand how their data is protected, and 84% would switch institutions over data mishandling concerns.

As AI agents become more integral to finance, banks must balance innovation with transparency, explainability, and a human touch to build lasting trust and deliver meaningful, personalized service.

Figure 4: Consumer Expectations for AI’s Impact on Financial Services (2024)

Source: Salesforce

Source: Salesforce

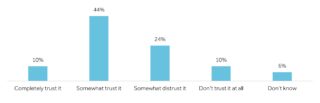

Figure 5: Consumer Trust in the Use of AI Agents in Financial Services (2024)

Source: Salesforce

Source: Salesforce

Future Outlook: The Next Frontier of AI Agents in Finance

Over the next 5–10 years, AI agents will become even more integral to financial services, moving far beyond today’s capabilities. Generative AI models, like GPT-4, are already being used internally by banks such as Morgan Stanley and could soon power ultra-conversational banking assistants that craft personalized financial plans and generate customized reports in real-time. To ensure accuracy, institutions are pairing generative models with verified internal data using retrieval-augmented generation. By 2030, conversing with a bank’s AI assistant may feel like speaking with a knowledgeable human consultant.

Several key trends are expected to define the next phase of AI agents in finance:

1. End-to-End Personalized Banking

AI agents will increasingly handle entire processes, such as guiding customers through mortgage applications, transferring funds, or negotiating bills on their behalf. Some banks are already piloting AI-driven loan chatbots, paving the way for broader “agentic finance.”

2. AI as a Primary Financial Advisor

Deloitte forecasts that by 2028, around 80% of retail investors will rely on AI for investment advice. Human advisors will shift toward “coaching” roles, focusing on behavioral aspects while AI handles evidence-based recommendations.

3. Embedded AI in Ecosystems

Banks are integrating AI services into third-party apps, messenger platforms, and smart speakers like Alexa. This “banking everywhere” model will provide frictionless access to services but will require careful handling of privacy and consent.

4. Hyper-Personalization

AI will tailor financial solutions based on real-time life events, geolocation, and behavioral data—with full customer consent. Ethical personalization will significantly improve customer outcomes while maintaining trust.

5. Continuous Learning and Adaptation

Future AI agents will continually refine their models based on each user’s behavior and preferences, allowing them to anticipate financial needs proactively and deliver increasingly sophisticated support.

In short, AI agents are on track to transform financial services into hyper-personalized, omnipresent, and intelligent ecosystems—redefining how consumers manage their financial lives.

Conclusion

AI agents have firmly established themselves in finance, redefining personalized banking, investment management, and internal operations. From 2020 to 2025, AI adoption reached a tipping point, with nearly every major institution embracing these technologies and delivering tangible benefits.

As customer expectations rise, the firms that succeed will be those that balance innovation with trust, blending AI’s efficiency with human oversight, empathy, and ethical judgment. The future envisions AI agents managing finances seamlessly in the background, optimizing financial well-being while still relying on human expertise for complex decisions. Achieving this vision will require continuous technological progress, responsible governance, and unwavering customer trust. As the AI revolution accelerates, institutions that leverage AI agents effectively are positioned to transform banking and wealth management for the better.

References

- Bank of America (2025)

- Statista (2025)

- The Financial Brand (2025)

- World Economic Forum (2025)

- Coforge (2024)

- Deloitte (2024)

- McKinsey (2024)

- Morgan Stanley (2024)

- Salesforce (2024)

- EY (2023)

- Fanatical Futurist (2023)

- Fluid AI (2023)

- PYMNTS (2023)

- Salesforce (2023)

- DBS Bank (n.d.)