The Evolution of Banking from Branches to Bytes

In the early 20th century, banking was all about physical branches. People walked into banks to deposit money, take out loans, transfer funds, and manage their investments. It was a secure and structured system, built on trust and in-person interactions. But as technology advanced, banks had to rethink their approach. Customers started expecting faster, more convenient services, and the old brick-and-mortar model was not enough anymore. This push for modernization sparked a new wave of innovation, leading to the rise of “Neobanks”, digital-first financial institutions designed to meet the needs of a tech-savvy generation.

Neobanks, also known as challenger banks, are digital-first financial institutions that operate entirely online, without any physical branches. These banks take advantage of advanced technology and rely on data to generate insights to provide a range of customized banking and financial services, including saving accounts, payment, loan and financial management solutions to individual and businesses.

Neobanks are on the Fast Track to Success

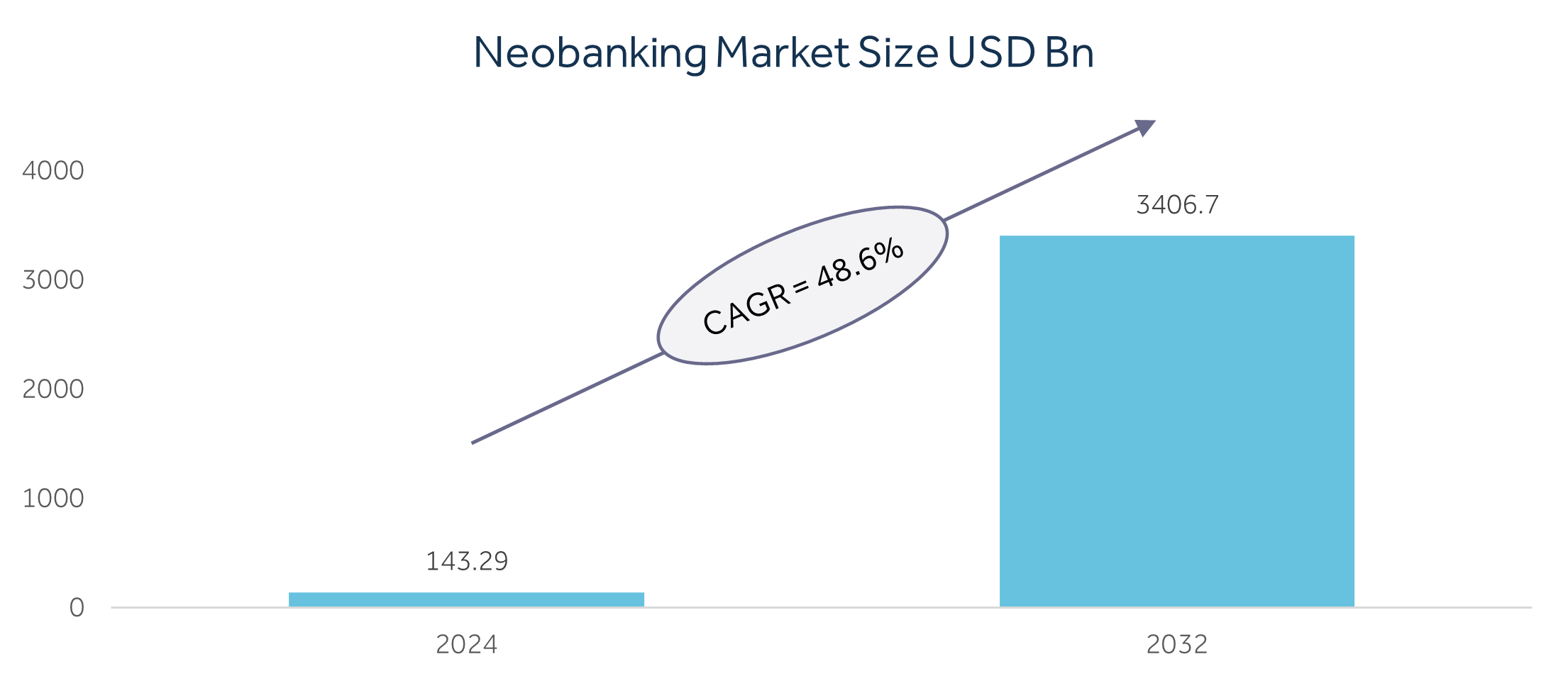

The overall market for Neobanks is relatively small, compared to the banking industry in terms of transaction volumes and users. However, the growth of Neobanks cannot be ignored. According to Fortune Business Insights, the global Neobank market is expected to grow at a CAGR of 48.6% during 2024-2032 from USD 143.29 billion in 2024 to USD 3.4 trillion by 2032.

Source: Fortune Business Insights

Source: Fortune Business Insights

Europe holds the largest share of 38.2% in the global Neobanking market. The solid demand of innovative fintech solutions, growing adoption of technology by financial institutions, and expanding collaboration between neo-banks and traditional financial institutions were the key reasons for strong hold in the European market. Followed by Europe, the US is the second largest market for Neobanks.

The Asia-Pacific region is likely to fuel growth for Neobanks in the near future. The growth will be led by rising internet penetration, growing adoption of smartphones, and demand for a customized banking service. Emerging economies, primarily China and India, are likely to be the growth engine of APAC as they are witnessing improved financial literacy and increased government initiatives to promote digitalization.

In the Middle East, the Neobanking sector is expected to grow rapidly, supported by a young, tech-savvy population, favorable legislative frameworks, and high focus on innovation. According to Boston Consulting Group (BCG), the Neobanking market in the Gulf Cooperation Council (GCC) region is likely to reach USD 3.45 billion by 2026, as Neobanks are expected to be integrated with the mainstream financial services landscape.

Why are Neobanks Winning the Banking Game?

1. Global Accessibility

Neobanks services can be accessed anytime and anywhere, eliminating the need of physical branches. They offer intuitive digital platforms and mobile apps that allows consumers to manage their banking needs at their convenience.

Numerous Neobanks further improve this accessibility by giving multi-currency accounts and international money transfers at low foreign transaction fees. These features simplify cross-border transactions and appeal to a global audience seeking convenient and cost-effective financial solutions.

Accessibility is one of the main differentiators for Neobanks compared to their traditional counterparts. As per App Radar, Neobanks have surpassed traditional banks in app user acquisition in 2023 by gaining 18 million additional users, which indicates the rising dominance and shifting preferences of modern banking customers.

2. Rapid Product Rollouts

Neobanks generally roll out products at a rapid pace. Considering their technology edge, they have the capability to launch new products and upgrade & change existing products as per consumer preferences within a time span of few weeks or months. Traditional banks in general lag in this space and may take years to come up with new products in the market.

Neobanks operate with dynamic, full-stack teams that include product owners, designers, data scientists, and specialists in legal, risk, operations, and marketing. While traditional banks are working towards adopting similar structures, their rigid hierarchies and reliance on legacy systems often slow down product development. In contrast, Neobanks leverage agile, configurable tech platforms and cross-functional collaboration, enabling them to rapidly prototype, test, and scale new products, keeping pace with shifting market demands.

3. Transparent Cost Structures

Neobanks differ from traditional banks by providing services with transparent and clear fee structures that empower customers to know exactly what they are paying for and eliminate uncertainty that generally comes with hidden charges.

The transparent fee structure gives Neobanks a strategic advantage and addresses the challenge of vague fee structures in traditional banking. This clarity on fee structures not only improve trust and confidence but also elevates customer experience and position Neobanks as a preferred choice among modern and digitally aware banking consumers.

4. Personalized Customer Experiences and Propositions

Neobanks rely on technology such as artificial intelligence, big data, and data analytics to study consumer preferences and requirements to provide personalized solutions. Neobanks analyse various data points such as transaction history, savings patterns, and consumer personas to provide customized financial advice and products to consumers. This personalization is generally not possible in traditional banking and provides neobanks a strategic advantage.

As per a study from Bain & Company, over 70% of consumers reported a strong interest in having their primary bank use personal data to make their banking services even more personalized. It shows that the demand for customized financial products is increasingly expanding, and personalization could be the only catalyst for achieving customer satisfaction in modern banking.

5. Advanced Customer Support

Unlike traditional banks, which often rely on forms and questionnaires to resolve customer issues, Neobanks use chatbots, voice assistants, and live video consultations to deliver superior engagement. This approach not only enhances the customer experience but also drives significant cost efficiency.

According to McKinsey, operational cost savings from the effective use of chatbots in banking could reach USD 7.3 billion globally, equivalent to approximately 862 million hours of time saved.

How Can Neobanks Chart a Course for Sustainable Growth?

1. Strengthen Cybersecurity Measures

Considering Neobanks offer their services through online mode only, they are at a higher risk of cyber-attacks compared to traditional banks. As technology is advancing, cyber-attacks are also becoming more sophisticated. A single data leak may impact consumer trust and lead to unnecessary attention from regulators. Therefore, it is important for Neobanks to develop full-proof cyber security practices, invest in state-of-the-art tools, and regularly train employees to mitigate the risk.

Recently, Revolut, which operates a Neobanking arm in Lithuania, faced a cyberattack, which resulted in a financial loss of USD 23 million. Hackers took advantage of a software vulnerability that caused communication problems between its European and US payment systems.

2. Navigating Regulatory Compliance

Neobanks operate in a heavily regulated environment. Unlike traditional banks, where established regulatory frameworks exist, Neobanks generally start as tech-driven enterprises. Therefore, it becomes challenging for neobanks to understand complex banking regulations across different geographies.

Neobanks need to comply with various regulations such as anti-money laundering (AML), know your customer (KYC), capital and liquidity requirements under Basel III, and adherence to consumer protection and consumer privacy laws. Furthermore, operating in multiple geographies adds complexity as they need to adhere to a wide range of different regulatory requirements across countries.

Neobanks will be able to better navigate the complex regulatory requirements by using AI for real-time transaction monitoring, actively engaging with regulatory bodies, and regularly training employees to be compliant with the requirements. Neobanks can also partner with RegTech organizations to smoothen the process of regulatory compliance.

3. Rapid Adaptation to Dynamic Consumer Preferences

In the digital age, consumer behavior is changing rapidly, which has created a challenging environment for Neobanks. Consumers nowadays expect to get seamless, intuitive experiences with innovative and personalized solutions.

The fast pace of technological advancements and the abundance of digital banking options have heightened these expectations. Neobanks must, therefore, remain nimble, responsive to shifting client demands and differentiate themselves from competitors. Failure to address these dynamic preferences effectively could lead to customer disengagement and hinder long-term growth.

4. Developing Sustainable Profitability Models

Profitability is one of the major areas of concern for Neobanks as they operate on a low margin model. To compete with traditional banks, they generally offer services at a low price to attract consumers. In addition, Neobanks invest significantly in technology and product innovation to remain agile and competitive in the market.

Neobanks shall work towards diversifying their revenue models, exploring fee-based services, and establishing partnerships that can provide them with additional revenue streams and ultimately improve profitability.

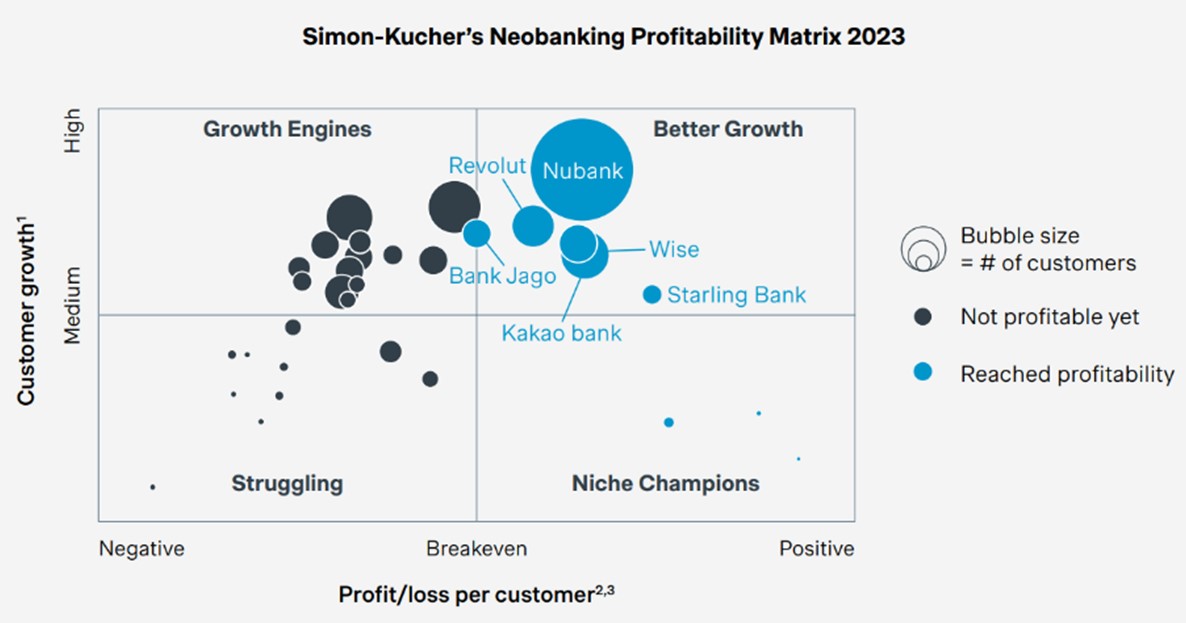

As evident in the Simon-Kucher NeoBanking Profitability Matrix 2023, majority of Neobanks are still not profitable due to a strong focus on scaling rather than achieving profitability.

As evident in the Simon-Kucher NeoBanking Profitability Matrix 2023, majority of Neobanks are still not profitable due to a strong focus on scaling rather than achieving profitability.

Despite all these challenges, the prospects of the Neobanking sector seem bright. Advantages such as 24X7 access, customized products and services, transparent cost structure, and improved customer services are contributing to its growth and paving a lucrative pathway for Neobanks’ success in the near future.

The Road Ahead for Neobanks: The Journey Has Just Begun

Neobanks have disrupted the banking industry by offering seamless, tech-driven, and customer-centric solutions that satisfy the needs of the digital world. Their meteoric rise on the back of transparency, personalization, and global accessibility has led to a paradigm shift in how financial services are delivered and consumed. However, their journey is not without challenges. They face issues ranging from cybersecurity risks to the complexity of the regulatory framework. With profitability still an ongoing goal for many Neobanks, they must continually adapt to stay competitive in an evolving market.

The future of Neobanks depends on using real-time data analytics, artificial intelligence, and blockchain technology to become more efficient and build more trust among customers. Its partnership with legacy banks and fintech ecosystems can result in scaling opportunities, while also sticking to regulatory compliance. Furthermore, focusing on underserved markets and tailoring services to diverse demographic needs will unlock new growth opportunities.

Neobanks will be ready to not only change the future of banking but shape a world in which both convenience and access come together to offer an enhanced, financial inclusive world. The rise of Neobanks is just the beginning — what comes next promises to be even more transformative.

References:

- Fortune Business Insights (2025)

- PwC (2024)

- Robeco (2024)

- Fintech Global (2024)

- BCG (2023)

- Bain & Company (2023)

- Simon-Kucher (2023)

- EY (2022)

- McKinsey & Company (2022)