Introduction

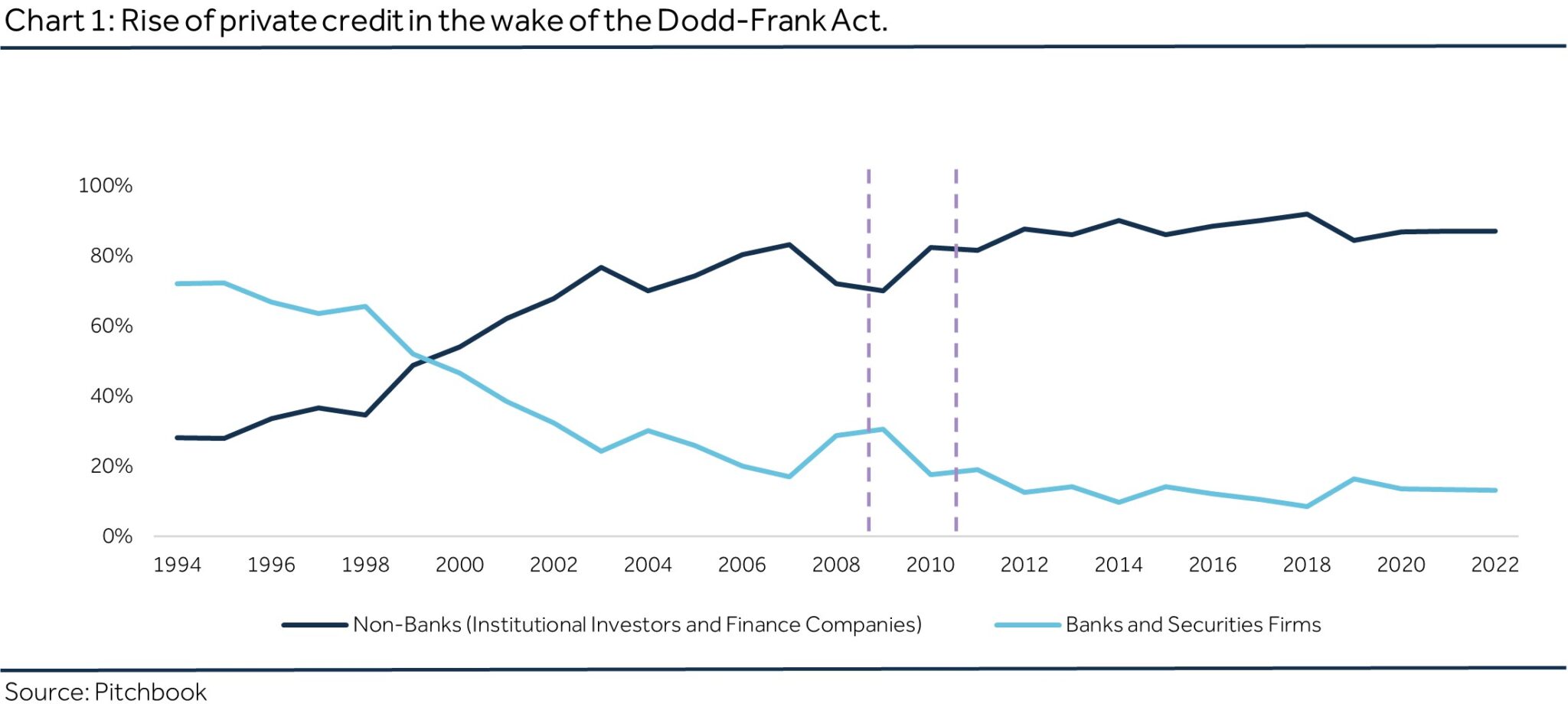

The year 2010 marked a significant shift in the financial landscape with the enactment of the Dodd-Frank Act. The Great Financial Crisis (GFC) of 2007-08 laid bare the reckless behaviors of commercial and investment banks, where relaxed leverage standards and the relentless pursuit of short-term profits culminated in a global economic catastrophe. To prevent a recurrence, policymakers and regulators swiftly introduced the Dodd-Frank Act, reasserting control over the financial sector and imposing stringent regulations on lending practices. As traditional banks began to retreat from specific lending markets due to these new regulations, private credit emerged as a powerful alternative, heralding a new era in finance.

The Emergence of Private Credit

The ascent of private credit as an alternative asset class was not a mere coincidence but a product of its unique characteristics such as speed in execution, control over covenants and terms, and strategic financial insights. These features have made private credit a favored option among investors, borrowers, and financial analysts, capturing the attention and curiosity of the market.

The Business Model

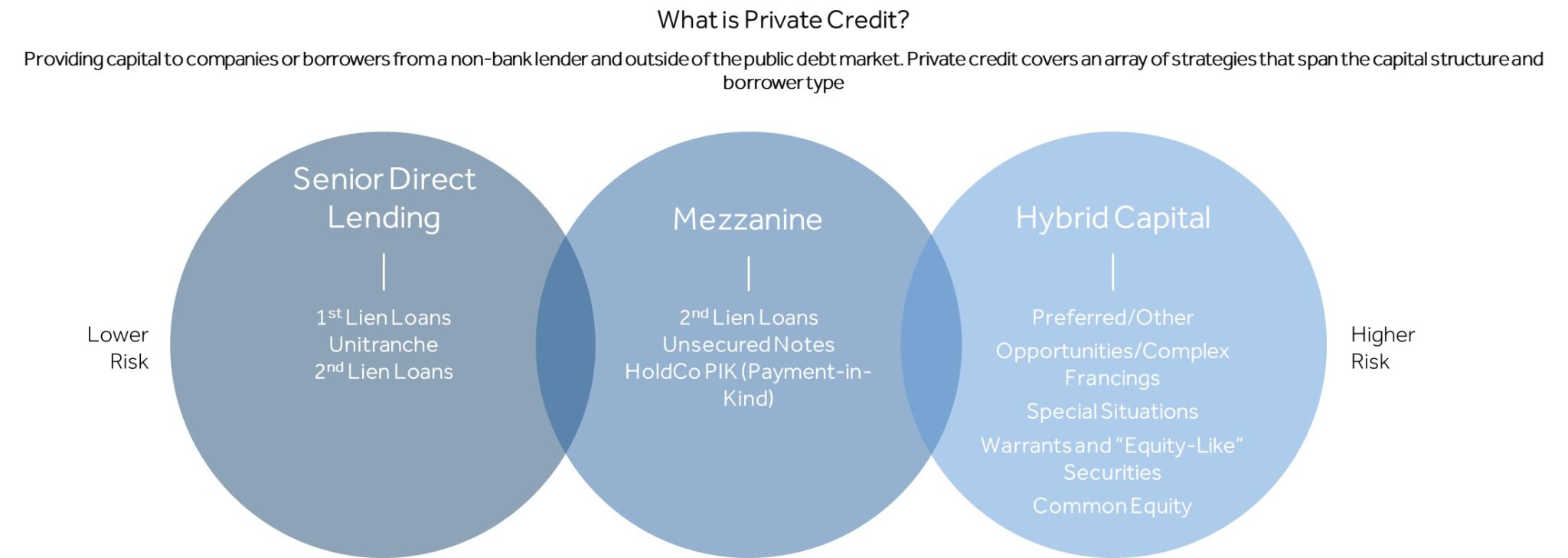

Private credit funds operate in a manner similar to private equity funds, but instead of acquiring equity stakes, they focus on credit transactions. This straightforward approach has been crucial to the rise of private credit. Before the Dodd-Frank era, borrowers typically turned to traditional lenders—commercial and investment banks—for loans, initiating a complex and lengthy process. Borrowers had to secure credit ratings, and underwriters had to assemble a consortium of lenders, leading to protracted negotiations over loan terms.

In contrast, private credit offers a more streamlined process. It involves a direct lending agreement between the borrower and the credit funds, facilitating swift execution. This efficiency allows private credit funds to respond quickly to market opportunities and borrower needs, bypassing the cumbersome procedures associated with traditional banking.

Chart 2: Private Credit and Typical Strategies

Source: Goldman Sachs

This business model’s simplicity and agility have positioned private credit as a compelling alternative to traditional bank loans. By eliminating the need for intermediary steps and complex negotiations, private credit can provide timely and tailored financing solutions, making it particularly attractive to borrowers looking for fast and flexible funding options.

Prudent Due Diligence

Another distinguishing feature of private credit is the thoroughness of its due diligence process. Private credit funds conduct comprehensive evaluations of borrowers, examining their operations, financial and legal standing, market position, and future prospects. This meticulous approach is akin to the private equity method, ensuring that investment decisions are well-informed and based on robust analysis.

Chart 3: Due diligence Process Followed at Private Credit Firms

Source: Private Credit: Opportunity Rising by the Alts Institute

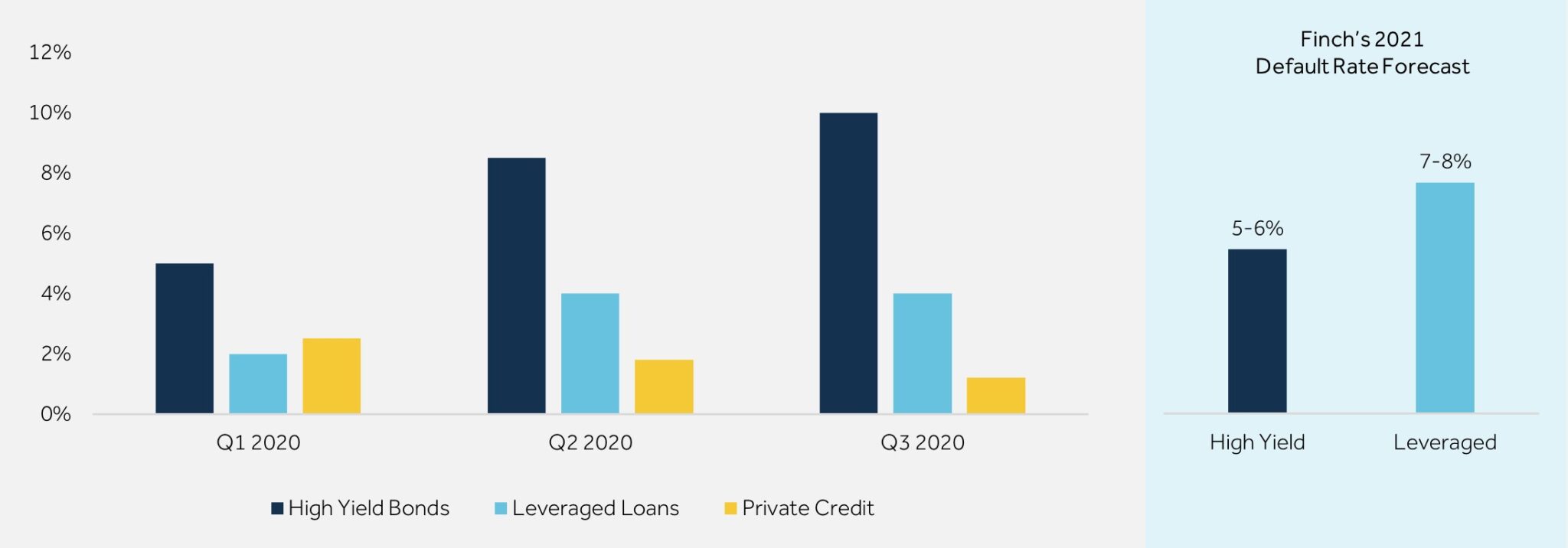

The due diligence process in private credit results in lower delinquency and default rates compared to public instruments. This is a testament to the effectiveness of private credit’s rigorous evaluation methods. By conducting detailed assessments and maintaining stringent underwriting standards, private credit funds can mitigate risks and enhance the quality of their loan portfolios.

Chart 4: Default Rates for Private Credit vs Leveraged Loans vs High-Yield Bonds

Source: Stellar Capital Management

Source: Stellar Capital Management

This rigorous due diligence process also enables private credit funds to structure loans with customized covenants and terms that align with the specific risk profiles of borrowers. This level of control and customization further differentiates private credit from traditional lending, where standardized loan terms may not adequately address the unique needs and risks of individual borrowers.

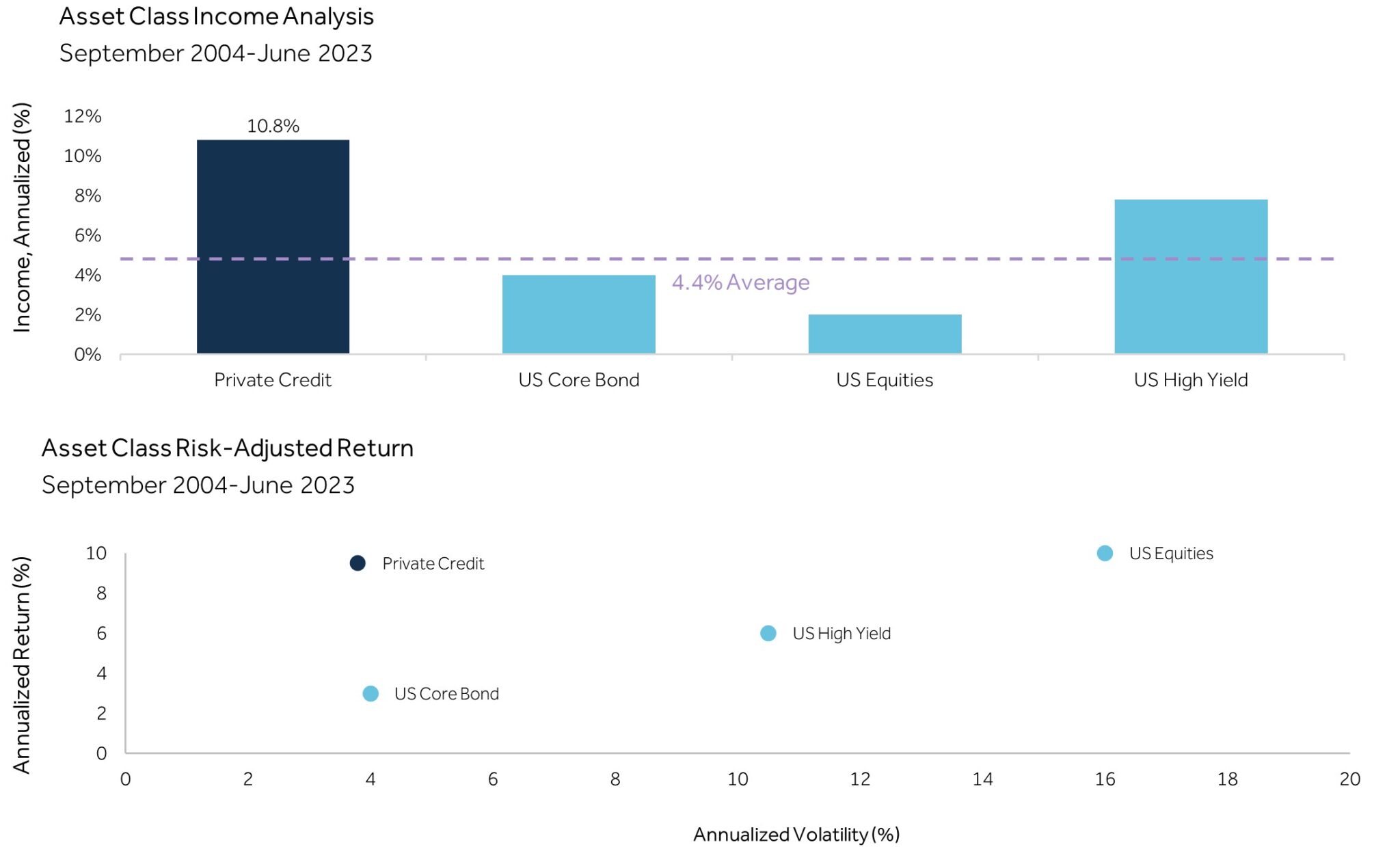

Superior Risk-Adjusted Returns

Private credit has attracted significant attention from investors due to its ability to generate superior risk-adjusted returns over the past two decades. Comparative analyses across major traditional asset classes reveal that private credit returns have consistently outperformed, offering a premium of approximately 300 basis points from September 2004 to June 2023. These returns were achieved during periods of high market volatility, demonstrating private credit’s resilience.

Chart 5: Private Credit Risk and Return Matrix from Sept 2004 – June 2023

Source: Oakhill Advisors “white paper on Private credit,” 2023

Source: Oakhill Advisors “white paper on Private credit,” 2023

Stability and Consistent Inflation-Indexed Returns

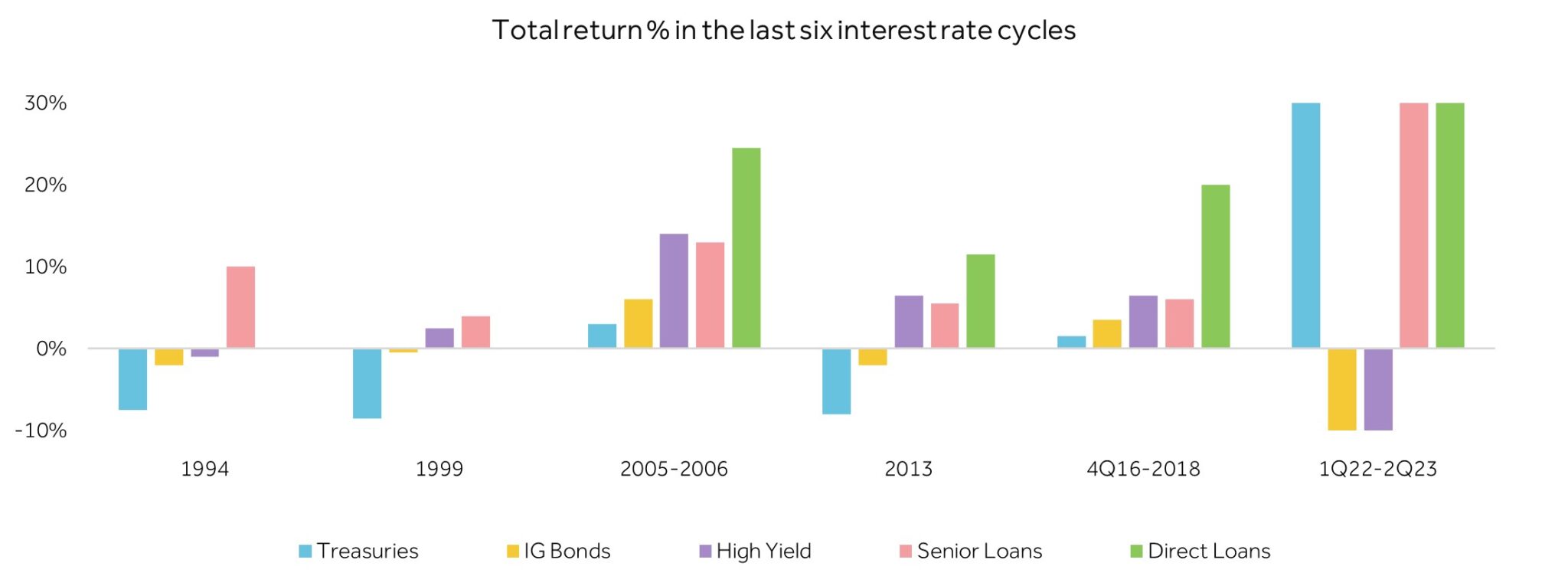

Private credit issuance is predominantly done at floating rates, ensuring that coupon payments are adjusted to prevailing interest rates. This feature has enabled private credit funds to achieve annualized returns of over 11-12% in the past 12 months, reflecting the high-interest rate environment. The floating rate mechanism also mitigates duration risk, a common concern for fixed-rate fund managers, thereby enhancing the stability of returns.

The ability to offer inflation-indexed returns makes private credit an attractive option for investors seeking to protect their portfolios against inflationary pressures. As interest rates rise, the floating rate structure ensures that returns are adjusted accordingly, providing a hedge against inflation and preserving the real value of investments.

Chart 6: Resilient Private Credit Returns through Interest Rate Cycles

Source: Private Credit: Opportunity Rising by the Alts Institute

Source: Private Credit: Opportunity Rising by the Alts Institute

This stability and resilience in returns, even in volatile market conditions, underscores the attractiveness of private credit as an asset class. By delivering consistent and inflation-adjusted returns, private credit funds can meet the income needs of investors while maintaining a strong risk management framework.

Outlook Amidst Headwinds: Can Private Credit Sustain Its Growth?

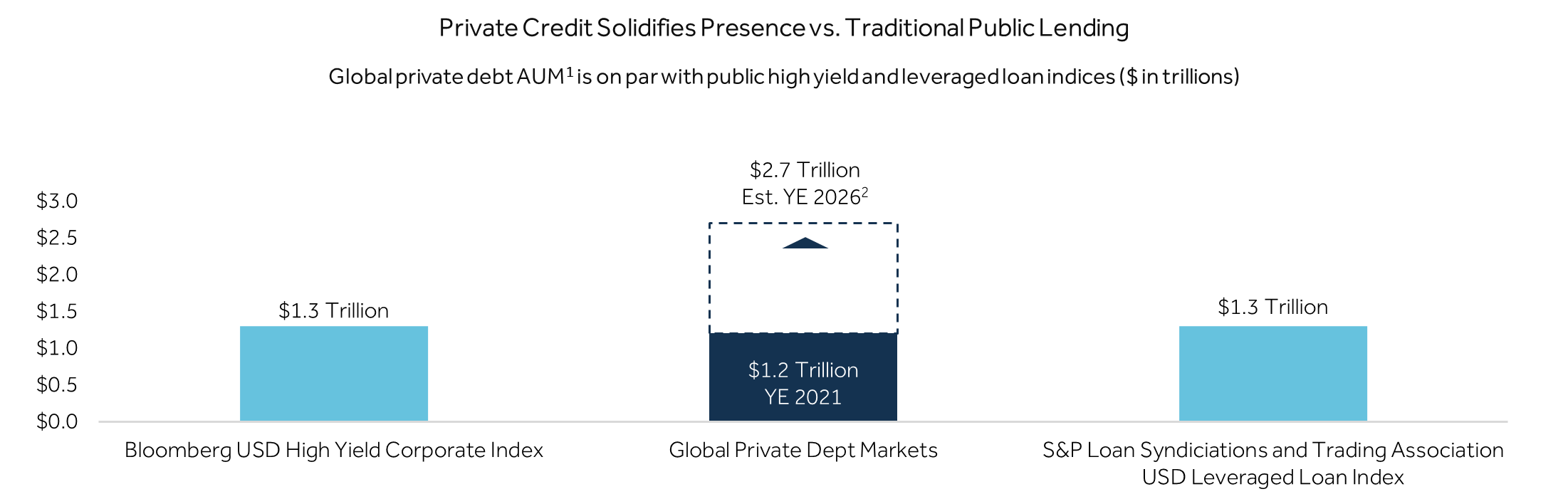

The private credit market has shown remarkable growth, with significant demand from financial circles. Established investment banks and firms are either building private credit teams or acquiring existing ones to capitalize on this trend. Goldman Sachs estimates that the private credit market will reach a staggering $2.7 trillion by 2026, growing at a compound annual growth rate (CAGR) of 17.6%.

Chart 7: Private Credit Outlook

Source: Goldman Sachs

Source: Goldman Sachs

Despite the promising outlook, several challenges could impede private credit’s ascent:

Reversal of the Interest Rate Cycle

The current high-interest rate environment, which has benefitted private credit, is expected to reverse. Central banks, including the European Central Bank and the Bank of Canada, have already begun lowering benchmark rates, and the Federal Reserve is anticipated to follow suit. A reduction in interest rates could diminish the attractiveness of private credit, which has thrived on clipping high-rate coupons.

As interest rates decline, the yield on private credit investments may decrease, potentially reducing the overall return for investors. This shift could lead to increased competition for high-quality loans and narrower spreads, challenging private credit funds to maintain their performance levels.

Private credit funds will need to adapt to this changing interest rate environment by exploring new investment opportunities, adjusting their lending strategies, and enhancing their risk management practices. By remaining agile and responsive to market dynamics, private credit funds can continue to deliver attractive returns despite the anticipated reversal in interest rates.

Refinancing Risks

Higher-yield private loans are increasingly being refinanced through syndicated deals. As of May 2024, $16 billion in loans had already been refinanced. A substantial increase in refinancing activity could negatively impact the private loan market by reducing the pool of high-yield opportunities.

Refinancing risk poses a significant challenge for private credit funds as borrowers seek to take advantage of lower interest rates and more favorable terms offered by syndicated loans. This trend could lead to a reduction in the availability of attractive investment opportunities, pressuring private credit funds to identify new avenues for growth.

To mitigate refinancing risks, private credit funds may need to diversify their loan portfolios, seek out niche markets with less competitive refinancing dynamics, and strengthen their relationships with borrowers to secure long-term financing arrangements. By adopting a proactive approach to managing refinancing risks, private credit funds can sustain their growth and maintain a robust pipeline of investment opportunities.

Challenges in Sponsor LBO Transactions

Private credit has been a key player in sponsor leveraged buyout (LBO) transactions, providing the leverage needed for buyouts. However, the private equity sector has faced difficulties in liquidating portfolios and managing valuations, leading to stalled deal cycles. This could result in fewer buyout credit deals, impacting private credit’s growth prospects.

Sponsor LBO transactions have been a significant driver of private credit demand, but recent challenges in the private equity sector have raised concerns about the sustainability of this growth engine. Valuation pressures, limited exit opportunities, and heightened competition have contributed to a slowdown in deal activity, potentially reducing the volume of buyout credit transactions.

Private credit funds will need to navigate these challenges by exploring alternative financing structures, targeting middle-market and growth-stage companies, and leveraging their expertise in complex transactions. By diversifying their investment strategies and identifying new sources of demand, private credit funds can continue to play a vital role in sponsor LBO transactions while mitigating the impact of sector-specific challenges.

The Path Forward: Resilience or Decline?

The future of private credit hinges on its ability to navigate these headwinds. The asset class has demonstrated resilience through its strategic attributes and strong risk management practices. However, the evolving macroeconomic environment and market dynamics will test its sustainability.

Strategic Adaptation

Private credit funds must adapt to changing interest rate cycles and refinancing trends. This could involve diversifying their investment strategies, exploring new market segments, and enhancing their due diligence processes to maintain high standards of credit quality.

Strategic adaptation will be crucial for private credit funds to stay ahead of market trends and capitalize on emerging opportunities. By expanding their investment horizons and leveraging their expertise in niche markets, private credit funds can sustain their growth and continue to deliver attractive returns to investors.

Leveraging Technology

The integration of technology in due diligence and risk assessment processes can further strengthen private credit’s position. Advanced data analytics, machine learning, and artificial intelligence can provide deeper insights into borrower profiles, market trends, and risk factors, enabling more informed decision-making.

Technology can enhance the efficiency and accuracy of private credit operations, enabling funds to identify high-quality investment opportunities, streamline underwriting processes, and improve risk management practices. By embracing digital transformation, private credit funds can maintain a competitive edge and drive innovation in the industry.

Expanding Global Reach

Private credit funds can also explore opportunities in emerging markets, where traditional banking systems may be less developed, and there is a higher demand for alternative financing solutions. Expanding their global footprint can open new avenues for growth and diversification.

Emerging markets offer significant growth potential for private credit funds, providing access to new borrower segments and less competitive investment landscapes. By establishing a presence in these regions and building strong local partnerships, private credit funds can tap into underserved markets and drive sustainable growth.

Conclusion

Private credit has emerged as a significant force in the financial landscape, offering superior risk-adjusted returns and stable performance amidst market volatility. However, its continued ascent is not guaranteed. The reversal of interest rate cycles, refinancing risks, and challenges in sponsor LBO transactions present substantial obstacles.

References:

- Financial times (2024)

- Alliance Bernstein (2024)

- J.P. Morgan (2024)

- The Economist (2024)

- Euromoney (2024)

- Bloomberg (2024)

- Forbes (2023)

- J.P. Morgan (2023)

- Blackstone (2023)

- The Alts Institute (2023)

- Stellus Capital Management, LLC (2022)

- Goldman Sachs (2022)