The New Language of Luxury

Luxury no longer sits only on the runway or in a retail boutique. Across major global cities, fashion houses are stepping into cafés, hotels, resorts, and even social clubs. The idea is simple yet powerful: rather than waiting for customers to walk into a store, brands are meeting them in daily rituals, where they eat, travel, and unwind. That shift changes luxury from an occasional purchase into something people live with more regularly.

The drivers are both cultural and commercial. Consumers, especially younger generations, are prioritizing experiences over possessions, while traditional retail no longer delivers the margins it once did. Hospitality fills that gap. It offers brands a stage to immerse consumers in their identity, to capture attention for longer, and to generate revenue streams that extend well beyond a single transaction. In many ways, the future of luxury will be defined less by products displayed on a shelf, and more by the environments and experiences that surround them.

Macro Drivers Behind the Trend

Changing Consumer Behavior: From Products to Experiences

Luxury is shifting from a marker of status to a way of expressing identity and belonging. Across markets, consumers, especially Millennials and Gen Z, increasingly spend on experiences that are personal, memorable, and easily shared. Spending on luxury experiences is projected to grow by 5–9% annually through 2030, reaching as much as EUR 2.5 trillion by the end of the decade. This is not just about preference but about habit: younger generations expect brands to meet them in social settings that feel aesthetic and emotionally resonant. Platforms such as Instagram and TikTok accelerate this shift by rewarding moments that can be captured and shared, pushing luxury away from static possessions toward lived encounters.

For brands, the implication is clear. Products alone are no longer enough to secure relevance. To stay competitive, luxury houses must design experiences that extend the brand into daily life while still protecting exclusivity. The opportunity is to translate symbols of ownership into stories people live and broadcast. The risk, however, lies in overextending. When hospitality ventures feel disconnected from the core brand or are poorly executed, they can dilute equity instead of strengthening it.

High-Margin Potential and Business Resilience

Hospitality is proving attractive not just for its cultural appeal but for the stability it brings to the business model. Branded hotels, cafes, and resorts generate recurring, high-margin revenue while extending the customer lifecycle. A guest who stays in a branded hotel or dines at a fashion cafe is not just spending once, they are engaging with the brand across multiple touchpoints, which aims to deepen loyalty and raise lifetime value. In volatile retail cycles, this diversification provides resilience and helps smooth revenues that are otherwise dependent on seasonal collections or flagship sales.

At the same time, hospitality ventures require capital and operational expertise that many fashion houses do not naturally possess. Partnerships with experienced operators are often essential to make the economics work. Success comes when the venture amplifies the brand’s identity and narrative without becoming a distraction. The houses that will lead in this space are those that treat hospitality not as marketing gloss but as a strategic extension of their value chain.

Collaboration Models: Fashion’s Hospitality Strategies

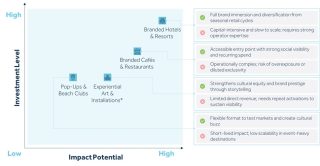

Luxury fashion’s ventures into hospitality are not uniform. They vary in scale, risk, and purpose, ranging from low-investment cafés to capital-heavy hotels. Each approach reflects a different way of translating brand identity into lived environments. What distinguishes success from failure is not the format itself but how well it aligns with the brand’s DNA and whether it creates genuine, repeatable engagement.

Branded Cafés and Restaurants: Accessible Entry Points

Food and beverage has become the most common entry point into hospitality for fashion houses. Unlike a handbag or watch, a coffee or dessert is attainable for a much broader audience while still carrying a sense of exclusivity. Giorgio Armani’s Paris restaurant in 1998 was one of the first attempts to bridge the runway with the dining table, reflecting the house’s minimalist aesthetic in cuisine and design. For years, such initiatives remained niche, but the rise of Instagram shifted the equation: suddenly every plate, latte, or wall became a piece of content.

Tiffany & Co.’s Blue Box Café illustrates how these ventures can transition from experiment to enduring strategy. Initially opened in 2017 as part of a flagship renovation, it was dismissed by some as a PR exercise. Yet the concept gained lasting traction. Its robin’s-egg-blue interiors and curated menu transformed “breakfast at Tiffany’s” into a literal experience, generating organic global attention and positioning the café as a natural extension of the brand’s heritage

Branded cafés and restaurants create value such as accessibility and exclusivity, however, at the same time, these models are not without risk. Poorly executed concepts can feel gimmicky, particularly if the design, menu, and storytelling fail to cohere. Operationally, cafés demand capabilities outside the core expertise of most fashion houses, making them complex and costly to sustain. There is also the danger of overexposure, while accessibility expands reach, too much of it risks diluting the very exclusivity that underpins luxury. These trade-offs highlight the need for careful calibration between novelty and authenticity, accessibility and aspiration.

Branded Hotels: Immersion at Scale

Hotels sit at the high-commitment end of the spectrum. They transform a brand from a retail touchpoint into a 24-hour lifestyle. Armani’s hotels in Dubai and Milan are perhaps the clearest examples, each detail, from the architecture to the service rituals, reflects the same codes that shape its clothing. Dior’s spa partnerships with Belmond extend the logic differently, weaving couture sensibilities into wellness environments from treetop cabins in Taormina to a luxury train in Scotland. Both illustrate how hospitality can stretch fashion identity into entirely new domains. The advantages of hotels are their ability to create ecosystems. Guests who may never own couture enter the brand universe for days at a time, generating cultural visibility and deepening emotional loyalty. They also provide recurring income streams that diversify away from seasonal sales.

Yet the challenges are substantial. Branded hotels are capital-intensive, require long development timelines, and demand operational capabilities well beyond the core competencies of most fashion houses. As a result, partnerships with established hospitality operators are not merely advantageous but often indispensable. In this way, hotels magnify exposure to executional risk offering significant rewards for flawless delivery but imposing equally severe consequences for missteps.

Pop-Ups and Beach Clubs: Buzz and Experimentation

Short-term activations have become a way to test concepts while creating cultural moments. Jacquemus has excelled in this space. Its Café Citron pop-up in Paris, with lemon-themed interiors and limited-edition desserts, captured the brand’s Mediterranean spirit in an approachable format. The Monte-Carlo Beach Club takeover went further, transforming an iconic Riviera setting into a branded leisure environment complete with signature sunbeds and exclusive merchandise.

These initiatives thrive on scarcity and shareability. They resonate particularly with Gen Z audiences, who value limited, photogenic experiences. The advantage for brands is agility: they can experiment without committing large capital and learn what resonates before scaling. However, Pop-ups risk fading as quickly as they appear unless they tie into a longer narrative or leave behind lasting brand associations.

Immersive Art Spaces: Building Cultural Halo

For fashion houses not yet ready to commit to the capital demands of food and beverage or hotel ventures, art-led spaces provide a flexible yet high-impact alternative. Blurring the lines between gallery, lounge, and retail, these environments function as cultural laboratories where brands can experiment with narrative, engagement, and hospitality-like immersion. Most recently, Dior brought its traveling “Dior Heritage” exhibition to Saudi Arabia, transforming cultural heritage spaces into immersive fashion narratives. Such examples show how exhibitions can anchor luxury within a region’s cultural identity, extending their influence far beyond retail. What unites these initiatives is their ability to operate as narrative galleries spaces designed to tell deeper stories, align with the worlds of art and culture, and generate organic media visibility.

The strength of this model lies in its flexibility and prestige. By associating with cultural institutions and high-profile venues, brands elevate their standing and secure powerful media visibility without the need to invest in permanent assets. However, the trade-offs are significant. Compared to cafés or hotels with recurring revenue models, exhibitions and cultural installations generate limited direct financial return. They are resource-intensive to stage and reliant on continuous novelty to maintain attention. Over time, the impact is measured less in income and more in brand equity meaning these formats deliver their strongest value when paired with broader strategies that reinforce identity and long-term positioning. Each of these models plays a different role in the way fashion houses approach hospitality. Cafés and pop-ups create energy and visibility, often acting as the first step into a wider lifestyle play. Hotels and resorts demand far more resources but can deliver full immersion when executed well. Art spaces, meanwhile, reinforce cultural standing, even if they don’t always move the revenue needle.

* Experiential Art installations are low-cost, but maintaining visibility through repeated activations raises overall investment to a medium level.

What matters is the fit. The choice of model has to reflect the brand’s DNA, the market it wants to reach, and how much risk it can realistically take on. There is no single formula. Some houses will thrive on light-touch, fast moving activations, while others will push into heavy, long-term bets. The brands that get it right are those that treat hospitality not as an add on, but as a natural extension of their world.

Implications for the GCC

The GCC is uniquely positioned to host the fashion–hospitality convergence, with rapid tourism growth, large scale cultural investment, and a consumer base drawn to exclusivity. In 2023, international tourist arrivals to the GCC surpassed 60 million, with Saudi Arabia alone targeting 150 million annual visitors by 2030. Governments across the region are positioning culture, entertainment, and lifestyle as pillars of diversification, creating an ecosystem where luxury brands are no longer visitors but long term investors in cultural and experiential infrastructure.

Fashion Meets Place: How Leading GCC Cities are Shaping the Trend

The GCC luxury hospitality story is being written through its cities, each taking a distinct path shaped by national priorities and urban strategies. Understanding these distinct models is critical for brands and government decision makers, as success depends on aligning with the unique identity each city is shaping.

- Riyadh: Heritage as a Stage for Global Luxury

Saudi Arabia has moved fastest in repositioning fashion within a cultural narrative. Dior’s Designer of Dreams exhibition at the Saudi National Museum reframed the brand’s history through the lens of local heritage and design. Rather than treating the exhibition as a standalone PR moment, Riyadh integrated it into the Riyadh Season, a national program of cultural placemaking. This alignment between fashion and policy reveals the city’s strategy to use luxury as an instrument of urban identity. Destination developers such as the Diriyah Gate Development Authority and the Royal Commission for AlUla now actively invite global brands to embed within heritage districts, blending couture storytelling with Najdi and Hijazi aesthetics. By linking couture with national identity, Riyadh is redefining luxury as a component of cultural policy, not just consumer preference. - Dubai: Turning Fashion into Lifestyle Infrastructure

Dubai has matured from retail capital to an experiential ecosystem. The Armani Hotel Dubai remains the region’s archetype for fashion driven hospitality, expressing brand minimalism through architecture. More recently, the rise of branded residences such as Bulgari Resort & Residences illustrates Dubai’s extension of couture into everyday life, embedding luxury narratives into residential living and community spaces. Dubai has a clear strategy to position itself as the operational epicenter for fashion houses seeking to commercialize lifestyle extensions, from branded F&B to resorts. The city’s integrated tourism infrastructure, international events calendar, and operational sophistication make it the natural scaling ground for ambitious luxury experiments. - Doha: Culture and Transit as New Runways

Qatar’s model revolves around cultural prestige and global connectivity. The Louis Vuitton Lounge by Yannick Alléno at Hamad International Airport blurs travel, dining, and fashion identity in a 24 hour luxury environment. Meanwhile, Valentino’s “Forever Valentino” exhibition at M7 in Doha demonstrated how the city leverages museum collaborations to anchor fashion within its national cultural narrative. Doha’s approach prioritizes curation over scale, favoring select high impact showcases supported by world class hospitality that convert culture capital into global visibility.

Together, these city models illustrate the GCC’s strategic diversity. Riyadh blends luxury with heritage, Dubai converts it into a lifestyle economy, and Doha frames it through culture and prestige.

Navigating Constraints

This acceleration is not without constraints. Seasonal tourism cycles and extreme summer conditions limit activation windows for outdoor formats. Market dynamics add another layer of complexity. Dubai, in particular, has reached a point of saturation, with multiple players competing for the same audience. In this crowded landscape, differentiation comes at a rising cost. Additionally, cultural nuance remains the most decisive factor, Western brand concepts must adapt to local codes of privacy, modesty, and family experience.

Taken together, these constraints are not obstacles but design parameters. The ventures that succeed do so because they translate brand identity into locally resonant forms rather than importing global templates.

From Hosting to Co-Creating

The GCC’s evolution marks a shift from hosting global fashion experiences to actively shaping them through collaboration. For luxury brands, the opportunity now lies in long-term partnerships with destination developers and cultural authorities rather than one-off activations. Developments such as Diriyah, AlUla, Qiddiya, and Doha’s cultural districts are emerging as platforms for structured co-design, where brand identity, heritage, and architecture intersect.

This progression reflects a more mature phase of regional development that integrates fashion into broader cultural, economic, and urban agendas. In doing so, the GCC is positioning itself not only as a market for global luxury but also as a contributor to how the next generation of experiential luxury environments is conceived.

The Future Outlook: Where the Convergence Is Headed

As fashion and hospitality continue to blend, the boundaries between product, place, and experience will become harder to distinguish. Luxury will no longer be something encountered occasionally in a boutique; it will unfold as a living environment shaping how consumers eat, travel, socialize, and relax. The café, the hotel, or the immersive exhibition will not sit on the edge of the brand they will become the brand.

The implications are significant. For fashion houses, hospitality is not simply diversification but a shift in the business model from seasonal sales to recurring, immersive engagement. The winners will be those that expand carefully, aligning ventures with their DNA, partnering with operators who can deliver, and designing experiences that strengthen loyalty rather than dilute it. For the GCC, the next decade offers a rare chance not only to host this evolution but to help define it, using giga projects and cultural initiatives as test beds for formats the rest of the world will later adopt. The future of luxury will be written less through what a brand sells and more through the worlds it builds. In that shift, the Gulf has the potential to move from being a showcase market to being a co-architect of global luxury’s most experiential chapter.

References:

- Business (2025)

- Armani (2025)

- Supdeluxe (2025)

- Monte Carlo bm (2025)

- Galerie Joseph Paris (2025)

- GCC Media Centre (2025)

- Bulgari hotels (2025)

- Bulgari hotels (2025)

- Louise Vuitton (2025)

- Forbes (2024)

- Saudi Tourism Authority (2024)

- Bain (2024)

- Business Insider (2020)

- Forbes (2020)

Related articles

Why Economic Gains Differ: The Underlying Economics of Formula 1 Host Cities

Full Throttle: The GCC’s Big Bet on Motorsport Excellence