Overview of the Hydrogen Economy

As global temperatures continue to rise, limiting global warming to 2°C above pre-industrial levels has become an urgent and imperative goal. However, achieving this target is fraught with significant challenges, as many industries remain heavily dependent on fossil fuels, particularly global energy systems, which account for three-quarters of greenhouse gas emissions. This challenge is particularly evident in energy-intensive industries such as chemicals, petrochemicals, iron, and steel manufacturing.

Decarbonizing the industrial energy sector is complex, as current renewable energy sources often fall short in addressing issues like intermittency and scalability. Consequently, the development of new low-carbon energy sources has become essential to overcoming these barriers. In this context, hydrogen is emerging as a pivotal solution in the transition to cleaner energy. Recognized by the International Energy Agency (IEA) as a vital tool for decarbonizing heavy industry and transport, hydrogen boasts high energy content and minimal carbon emissions when produced sustainably. Its potential is particularly significant in energy-intensive sectors, where it is increasingly viewed as a viable alternative to fossil-based energy sources. As countries seek to meet their climate goals, hydrogen’s role is expected to expand significantly, offering a promising pathway toward a more sustainable energy future.

Understanding Low-Carbon Hydrogen

What is Low-Carbon Hydrogen?

Historically, hydrogen production has been dominated by fossil fuel-based processes, contributing to high levels of CO₂ emissions. As the world transitions toward net-zero emissions, the focus has shifted to low-carbon hydrogen which is produced with minimal or no greenhouse gas emissions. However, there are challenges in scaling up these cleaner alternatives while balancing cost, infrastructure, and energy requirements.

Types of Hydrogen Production

Currently, hydrogen is classified into three different types based on its production process and carbon footprint:

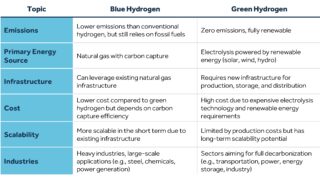

As the world transitions toward a low-carbon future, blue and green hydrogen are emerging as key solutions to decarbonize industries and energy systems. While both aim to reduce carbon emissions, they differ in terms of production methods, infrastructure needs, costs, and scalability:

The Role of Low-Carbon Hydrogen in the Energy Transition

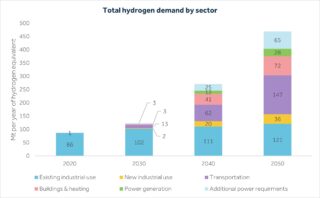

The global energy transition is driven by the need for energy security, sustainability, and economic growth. The Paris Agreement sets an overarching goal of limiting warming to 2°C, which necessitates adopting clean energy solutions, including Carbon Capture Utilization and Storage (CCUS) technologies and a circular carbon economy. Hydrogen, due to its clean combustion properties, is positioned to play a crucial role. It is projected that hydrogen demand is expected to increase up to 95% by 2050 (Figure 1), primarily driven by the heating and transportation sectors.

Figure 1- The change in hydrogen demand by sector from 2020 to 2050

Source: McKinsey Energy

Source: McKinsey Energy

Re-emergence of Interest from Government and Private Sector

In the 1990s and early 2000s, hydrogen was seen as a key player in the future of energy, however, it lost momentum due to infrastructure, economic, and technological challenges. Currently, there is renewed interest in hydrogen, driven by supportive policy targets and a range of private companies offering products and services across the value chain.

Government Strategies to Accelerate Hydrogen Adoption

Recognizing hydrogen’s potential to bridge gaps in their decarbonization strategies, governments around the world are stepping up efforts to promote hydrogen adoption through mandates, incentive programs, and targeted market-development tools.

The UAE’s National Hydrogen Strategy exemplifies this effort, by implementing clear targets, leveraging natural resource advantages, and fostering market development. The strategy focuses on building a domestic hydrogen economy by decarbonizing energy intensive industries such as steel, aluminum, petrochemicals, and heavy transport, while simultaneously establishing a robust export market to Europe and Asia. The UAE’s approach includes creating large-scale hydrogen energy hubs to drive local demand, developing policies to attract investment, and scaling up production to 1.4 million tonnes per annum (Mtpa) in 2031 and up to 14.9 Mtpa by 2050.

Government Policies & Incentives

Currently, governments worldwide are scaling up investments and implementing diverse policies to accelerate the supply and demand of low-carbon hydrogen. The supply-side policies typically focus on building hydrogen production capabilities, while the demand-side policies target the stimulation of hydrogen demand through supporting usage in industrial processes and other sectors (e.g. transport). In 2024, global public funding for the supply side totaled nearly USD 62 billion, 1.5 times higher than demand-side funding (USD 40 billion). This highlights the strategic priority given to hydrogen production, export capabilities, and infrastructure development.

Supply-Side Policies

1. Direct Grants and Subsidies

Advanced economies lead in providing direct grants to lower the CAPEX premium, reduce investment risks, and improve the cost of capital of low-carbon hydrogen. Notably, 99% of direct grants originate from developed markets, underscoring their capacity to finance large-scale hydrogen projects. For example, in 2024, the Netherlands allocated EUR 1 billion (USD 1.1 billion) to support large-scale renewable hydrogen production through electrolysis. This funding aims to cover up to 80% of the investment costs and provide operational expenditure (OPEX) support of up to EUR 9 per kilogram of hydrogen produced for a duration of 5 to 10 years.

2. Tax Incentives

Emerging markets and developing economies (EMDEs) predominantly use tax incentives to promote hydrogen adoption. Almost two-thirds of countries utilizing tax incentives fall within this category, highlighting a cost-effective approach to fostering hydrogen development. Recently, Brazil has introduced a USD 3.5 billion tax incentive program for 2028-2032, offering five-year tax credits for hydrogen produced from renewable energy or biofuels to accelerate the production of low-carbon hydrogen.

3. Competitive Bidding

Competitive bidding, or auction-based mechanisms, are increasingly used to drive investment in hydrogen production by awarding financial support to the most cost-effective projects. Through these auctions, project developers compete for subsidies or contracts by submitting bids that reflect the level of support they need. This process facilitates price discovery, enabling governments to allocate resources efficiently while encouraging cost reductions and technological advancements in hydrogen production. For instance, the European Union’s (EU) Hydrogen Bank auction in 2024 allocated EUR 720 million to seven renewable hydrogen projects, attracting substantial private sector interest and demonstrating the effectiveness of auctions in scaling up hydrogen investments.

Demand-Side Policies

While production targets exceed demand-side goals, efforts to stimulate hydrogen use are gaining traction. Notably, the EU has implemented regulations to help bridge the discrepancy between hydrogen production targets and current market demand by mandating the use of low-emission fuels and supporting investment in necessary infrastructure. Under the ReFuelEU Aviation and FuelEU Maritime regulations, companies are incentivized to use low-emission fuels, which is driving low-carbon hydrogen demand in refining and transport sectors. This is particularly crucial, as global low-emission hydrogen demand is projected to reach 10.5 Mtpa by 2030, with transport contributing to half of this growth.

Private-Sector Engagement and Offtake Agreements

Equally significant is the surge in private-sector investments, where the scale and number of offtake agreements (long-term contracts to purchase hydrogen) have grown substantially in recent years. By 2023, companies had signed deals for over 2 Mt of low-carbon hydrogen equivalents per year globally, with nearly 40% of these classified as firm agreements, which are legally binding contracts between hydrogen suppliers and buyers, helping to de-risk investments. A prime example is the NEOM Green Hydrogen Project in Saudi Arabia, a USD 8.4 billion initiative integrating 4 GW of solar and wind to produce 600 tonnes of green hydrogen daily. This project highlights the role of large-scale investments in renewable hydrogen production and positions NEOM as a global clean energy leader.

Challenges Facing Hydrogen Adoption

Despite the rising interest in hydrogen as a clean energy carrier, several hurdles prevent it from reaching its full potential:

1. High Production Costs and Market Barriers

One of the main challenges of producing low-carbon hydrogen is the high cost, which can be 2-3 times more expensive than fossil-based methods. This cost gap partially stems from a lack of market transparency as hydrogen currently lacks a standardized price index, limiting competition and leaving consumers with few incentives to move away from cheaper fossil fuels.

2. Challenges in Transport and Storage

Transport and storage of hydrogen present unique technical and logistical challenges. Hydrogen has a low volumetric energy density, requiring either liquefaction at extremely low temperatures (-253°C) or compression at high pressures, both of which demand energy-intensive processes. Additionally, hydrogen’s small molecular size increases the risk of leaks during storage and transport, leading to economic losses and safety risks due to its flammability and potential for explosion. Current storage technologies, such as high-pressure tanks or cryogenic systems, are expensive and not yet scalable for widespread use.

Furthermore, transporting hydrogen over long distances is similarly constrained by limited infrastructure. Globally, only a few thousand kilometers of hydrogen pipelines exist, and large-scale investments are needed to build new pipelines, storage tanks, and conversion facilities. Additionally, hydrogen embrittlement compromises the integrity of pipelines, storage tanks, and other infrastructure, increasing maintenance costs and failure risks.

3. Evolving Policy and Regulatory Frameworks

In addition to these economic and infrastructural challenges, policy and regulatory frameworks are still maturing. Early efforts focused on road transport applications, but the broader industrial, commercial, and residential use cases remain underdeveloped. Comprehensive national strategies are emerging in various countries, aiming to foster hydrogen supply chains, infrastructure, and end-use applications, however, meaningful progress depends on consistent and coordinated policies.

Hydrogen’s Role in the Renewable Energy Mix

Hydrogen offers distinct advantages for specific industries when compared to more common renewable energy sources such as solar and wind. Although these renewables have seen cost declines and rapid deployment, their intermittency and geographic limitations continue to pose persistent challenges. By contrast, hydrogen can be produced consistently, independent of weather conditions, stored for extended periods, and then used for heating, electricity, or transport when needed.

Moreover, hydrogen is particularly suited to industries that require high energy intensity, which direct electrification cannot easily provide. Heavy manufacturing sectors such as steel, cement, and chemicals rely on processes that demand intense heat, making hydrogen a more practical solution than solar or wind alone. Additionally, in the long-term, hydrogen enables large-scale electricity storage, facilitating trading and balancing between regions.

Hybridization for a Balanced Energy Mix

Given the respective strengths and limitations of hydrogen and other renewables, a hybridized approach may offer the most resilient pathway to decarbonization. By producing hydrogen via electrolysis when solar or wind power is abundant, renewable resources can be maximized rather than curtailed. This hydrogen can then be stored and used as needed for power generation, industrial processes, or transportation. Gas turbines fueled by hydrogen, for example, can provide on-demand electricity during periods of low renewable output, mitigating the risk of blackouts and enhancing overall grid stability. A well-structured energy system incorporates multiple sources to ensure security and sustainability. Hydrogen hybridization enhances renewable energy contributions by addressing variability and enabling sector coupling. Key approaches include:

The advantages of hybridization extend beyond flexibility and reliability. Pairing hydrogen with renewables supports energy security by reducing reliance on imported fossil fuels, stabilizing energy prices, and boosting local economies that invest in new infrastructure and technology. As these hybrid systems scale up, costs are likely to decrease, further encouraging adoption and innovation. In this sense, hydrogen’s role in complementing renewables is not merely a temporary fix, it can lay the groundwork for an interconnected, carbon-free energy ecosystem that leverages diverse resources to meet the demands of a sustainable society.

Conclusion

Low-carbon hydrogen is emerging as a critical resource to achieve sustainable energy goals. Despite challenges such as high costs and infrastructure gaps, hydrogen’s potential to decarbonize energy-intensive industries present as the most reliable and feasible option. Evidence shows that hydrogen is increasingly supported globally, with governments and corporations scaling adoption and production through targeted policies, incentives, and investments.

Furthermore, hydrogen complements the shortcomings of other renewable sources by addressing intermittency and providing high-energy solutions for energy-intensive industries, making it a key component in achieving a balanced energy mix. While significant investment and technological advancements are still needed, hydrogen’s role in achieving net-zero emissions will be fundamental and crucial to ensuring global energy sustainability.

References:

- IEA (2024)

- McKinsey Energy (2023)

- UAE Ministry of Energy and Infrastructure (MoEI) (2023)

- IPCC (2022)

- Oxford Energy (2021)

- UNFCCC, Paris Agreement (2015)