Introduction: The Beautiful Game

Football, often hailed as “the beautiful game” has undergone a remarkable transformation since its inception in 1863 (NBC, 2022). The sport has become a global economic powerhouse with billions of viewers spanning all corners of the world. Modern football is underpinned by a vast and intricate set of financial dynamics which encompass broadcasting rights, sponsorship deals, player transfers, and commercial revenues. This article delves into these financial mechanisms which have had a major impact on the growth and popularity of the sport.

Broadcasting Rights: The Golden Goose

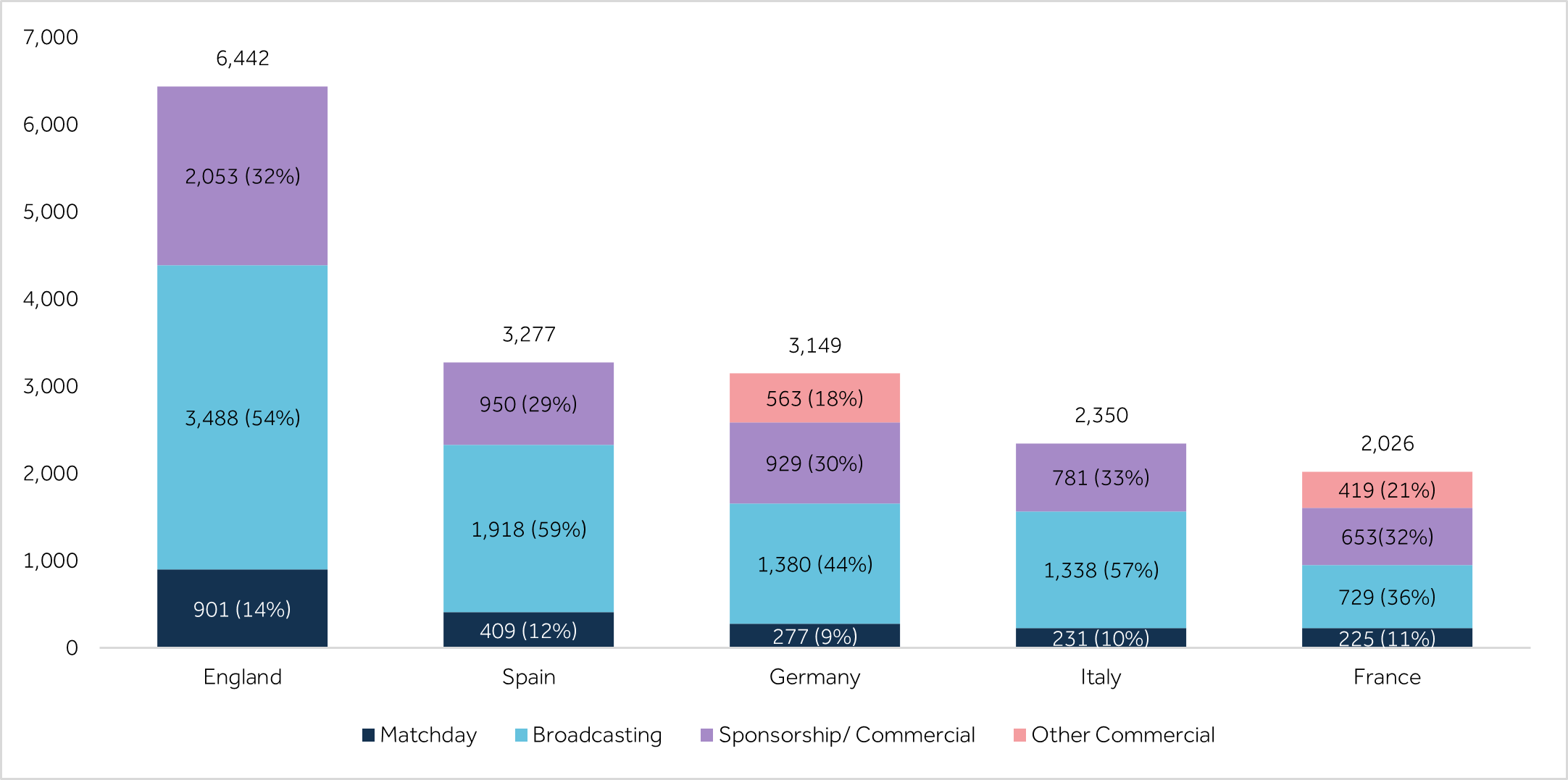

One of the primary financial drivers in modern football is broadcasting rights. The value of these rights has surged dramatically over the years, making them a cornerstone of football economics. According to Deloitte’s 2023 Annual Review of Football Finance, broadcasting rights across the ‘big five’ European leagues in the 2021/ 22 season represented ~50% of league clubs’ revenue on average (Deloitte, 2023).

Chart 1: Big Five European League Clubs Revenue – 2021/22 (€m) Source: Deloitte

Source: Deloitte

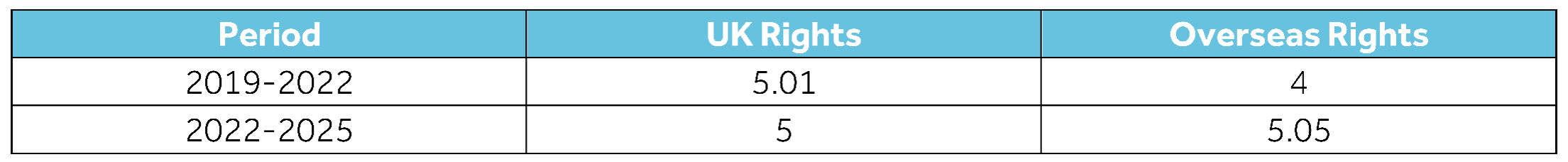

That being said, there is a significant gulf in revenue generated from TV rights between Premier League clubs compared to their European peers. In the 2021/ 22 season, Premier League clubs as a whole generated EUR 3.48 billion (USD 3.73 billion) in broadcasting rights revenue which is more than the aggregate broadcasting revenue generated by all clubs across both the Spanish and German leagues EUR 3.29 billion (USD 3.53 billion). This trend is likely to continue in the near future as the Premier League’s broadcasting revenue is expected to top GBP 10.05 billion (USD 12.79 billion) during the 2022-2025 period boosted by a ~26% increase from overseas rights (New York Times, 2023), further increasing Premier League clubs’ broadcasting revenue during this period.

Table 1: Premier League TV Rights (£b) Source: New York Times

Source: New York Times

Broadcasting revenue is crucial for both leagues and individual clubs with the COVID-19 pandemic underscoring the importance of this revenue stream, as many leagues faced financial difficulties due to the suspension of matches and the subsequent reduction in broadcast income.

Sponsorship and Commercial Deals: Building Global Brands

Sponsorship and commercial deals form another major pillar of football’s financial structure, which is especially evident among top clubs who secure lucrative sponsorship deals with global brands, significantly boosting their revenue. In September of 2023, Manchester United announced one of the biggest shirt sponsorship deals in world football with Snapdragon, a US technology company, earning them USD 75 million annually (Sports Business Journal, 2023).

Kit manufacturing deals further contribute to commercial revenue generated by clubs, Real Madrid generates the highest revenue from its kit manufacturing deal with Adidas worth USD ~128 million annually. In addition to kit manufacturing deals, teams are capitalizing on revenue from stadium naming rights. In 2022, Barcelona signed a 4-year sponsorship deal with Spotify worth an estimated USD 308 million. The deal covers both shirt sponsorship and stadium naming rights, netting the club ~USD 77 million per year (Sports Pro Media, 2022). These deals not only provide substantial financial inflows but also enhance the global visibility and brand value of clubs.

Table 2: Top 10 Kit Supplier Deals Source: Football Benchmark

Source: Football Benchmark

Player Transfers: The High-Stakes Market

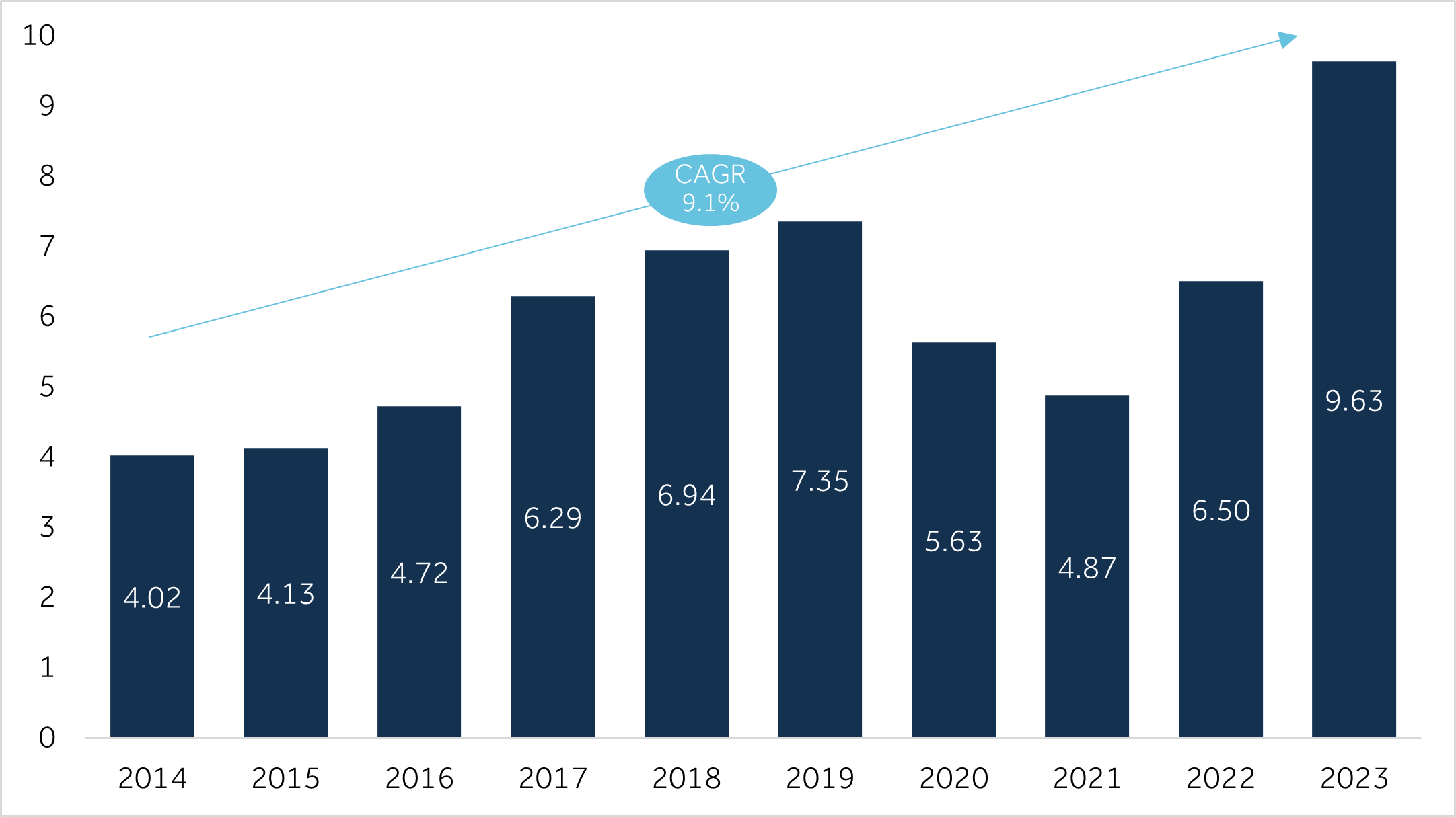

Player transfers are the most visible aspect of football’s financial dynamics, especially over the last few years as the player transfer market has seen a significant rise in transfer fees. According to FIFA’s Global Transfer Report 2023, after transfer spending fell in 2020 and 2021 due to the financial impact of the COVID-19 pandemic, outlays on players have increased, with 2023 total spend on players reaching USD 9.63 billion an increase of 48.1% compared to 2022 (FIFA, 2024).

Chart 2: Global Transfer Fees by Year ($b) Source: Fifa

Source: Fifa

English clubs spent the most on player transfers in 2023 setting a new record of USD 2.96 billion. Saudi Arabian clubs were the 3rd largest transfer spenders globally after England and France as they continue to draw some of the best players from European sides to the Saudi Pro League following the marquee signing of Cristiano Ronaldo (FIFA, 2024). In doing so, Saudi clubs spent a total of USD 970 million on transfers, an increase of 1,924% compared to the previous year.

Transfer fees for top players have reached astronomical levels, reflecting the financial muscle of elite clubs. For example, Neymar’s transfer from Barcelona to Paris Saint-Germain (PSG) in 2017 was for a fee of EUR 222 million (USD 263 million) which still remains the highest transfer fee ever paid (Forbes, 2024). In 2023, Chelsea set a Premier League transfer record with the signing of Argentina’s World Cup winner Enzo Fernández from Benfica for GBP 107 million (USD 132 million) (CNN, 2023). While such spending enhances squad strength and global appeal, it also brings financial risks, especially for clubs with limited revenue streams.

Matchday Revenue: The Traditional Pillar

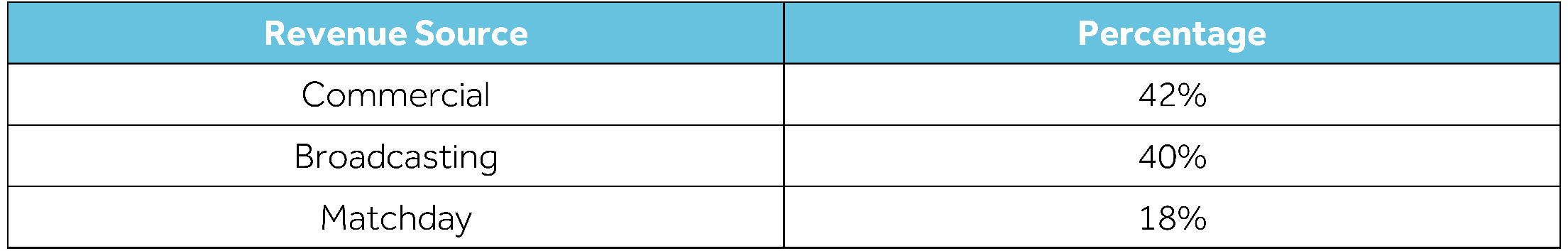

Despite the rise of broadcasting and commercial revenues, matchday revenue remains a vital component of football’s financial ecosystem. This includes ticket sales, hospitality packages, and other in-stadium purchases. According to Deloitte, matchday revenue accounted for 18% of the total revenue for Europe’s top 20 clubs in the 2022/23 season (Deloitte, 2024).

Table 3: Matchday Revenue Share of Europe’s Top 20 Clubs (2022/23 Season) Source: Deloitte

Source: Deloitte

The COVID-19 pandemic significantly impacted matchday revenue for all clubs globally, as matches were played behind closed doors or with limited attendance. KMPG estimated that the combined loss in match-day revenue across the top 5 European leagues due to the pandemic was ~EUR 500 million (USD 588 million) at the end of the 2019-20 season (The Stadium Business, 2021). Clubs like Real Madrid and FC Barcelona, which generate substantial matchday revenue due to their large stadium capacities, faced considerable financial challenges during this period.

The importance of matchday revenue to football clubs is far more significant than the financial benefits generated, it is integral to building and maintaining fan loyalty and engagement. Matchday experiences strengthen the emotional connection between fans and their clubs, encouraging repeat attendance and ongoing support.

As football evolves, clubs are exploring innovative approaches to enhance matchday revenue. Investing in stadium upgrades to increase capacity and improve facilities, offering more diverse and premium hospitality packages, and leveraging technology to streamline ticket sales and in-stadium purchases are all approaches being studied by clubs to enhance this revenue stream. Additionally, clubs are exploring dynamic pricing models for tickets, where prices fluctuate based on demand, opponent, and other factors, to maximize revenue (Smart Pricer, 2020). The traditional pillar of matchday income remains a critical component of a club’s financial stability and fan engagement strategy.

Financial Fair Play: Balancing the Scales

Implemented in the 2011/ 12 season, UEFA’s Financial Fair Play (FFP) regulations were introduced to ensure financial sustainability and fair competition among clubs. These regulations were drawn up in response to the growing financial disparity between clubs, where excessive spending by some clubs was leading to unsustainable debt levels and major competitive imbalances within leagues. As a result, FFP aims to prevent clubs from spending beyond their means and accumulating excessive debt as it requires them not spend more than they earn, ensuring they balance their books over a three-year period.

UEFA has the authority to impose sanctions on clubs that fail to comply with FFP regulations. These sanctions can range from fines and withholding of prize money to more severe penalties such as transfer bans and even exclusion from European competitions like the UEFA Champions League and Europa League.

Despite FFP leading to greater financial discipline among clubs, it has also been a subject of controversy. Critics of the regulations argue that it strengthens the dominance of wealthier clubs, which have larger revenue bases and are able to comply with FFP more easily. Smaller clubs, on the other hand, may struggle to compete financially, thus perpetuating the financial disparity in football.

The Role of Investors and Owners

The influx of wealthy investors and ownership groups has significantly altered the financial landscape of modern football, transforming clubs into global powerhouses both on and off the pitch. Roman Abramovich’s acquisition of Chelsea in 2003 marked the beginning of a new era, characterized by heavy investment in players and infrastructure.

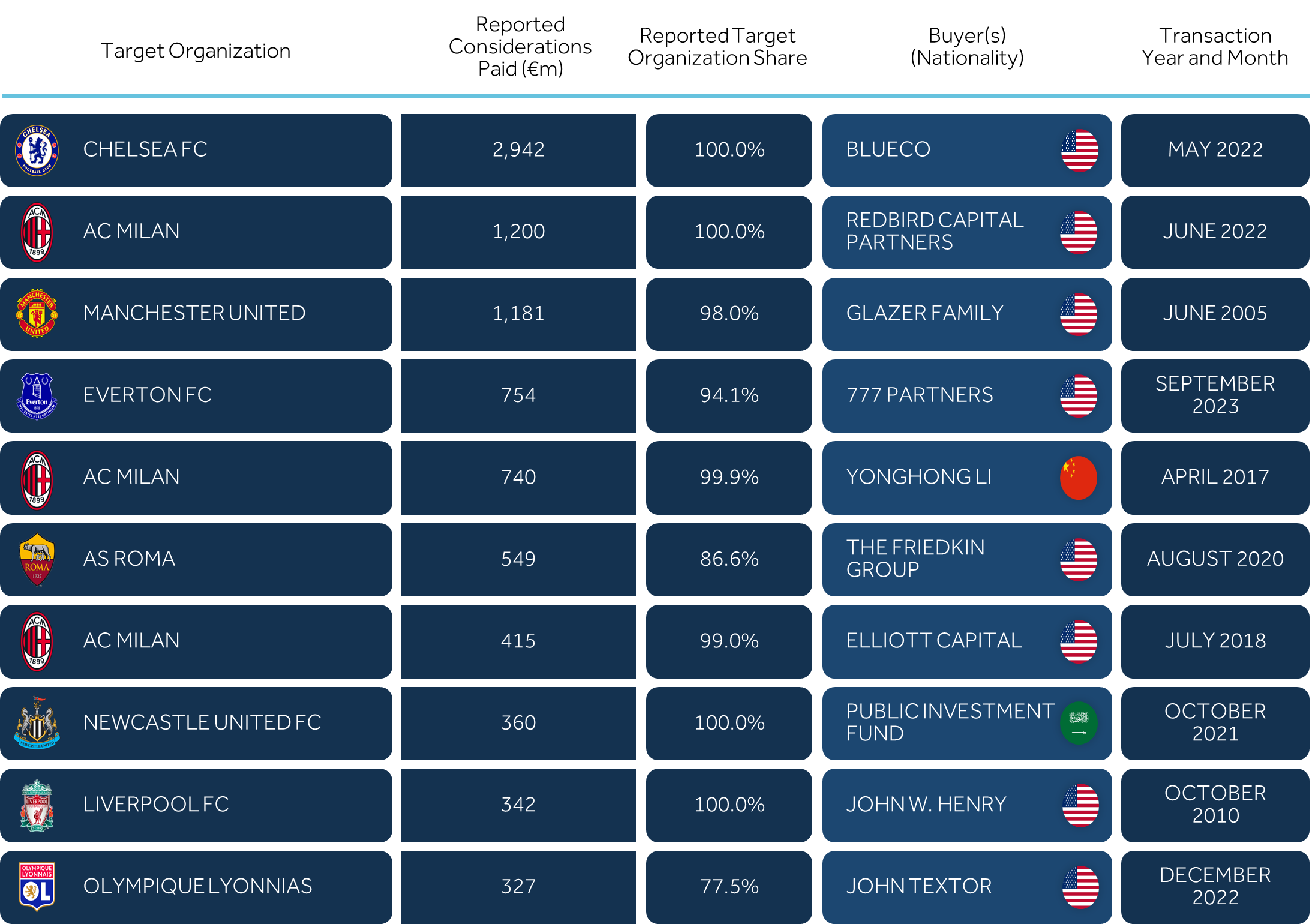

Table 4: Top 10 Club Transactions in the Big Five Leagues Source: Football Benchmark

Source: Football Benchmark

Similarly, the most recent acquisition of Chelsea FC by Blueco in 2022 and Newcastle United by Saudi Arabia’s Public Investment Fund in 2021 have led to significant financial injections, allowing these clubs to compete at the highest level. These types of ownership models provide vast financial resources to their respective clubs, however, they also raise questions about the sustainability and long-term impact on the clubs and the broader football ecosystem.

Conclusion

The financial dynamics driving modern football involve a complex interplay of broadcasting rights, sponsorship deals, player transfers, matchday revenue, financial regulations, and ownership models. While these factors collectively contribute to the growth and global appeal of the sport, they also present challenges related to financial sustainability and competitive balance.

As football continues to evolve, stakeholders must navigate these financial dynamics with a strategic and sustainable approach. Ensuring the sport’s long-term health will require balancing clubs’ commercial interests with the principles of fair competition and financial integrity. Beyond the pitch, the financial mechanisms at play will continue to shape the future of football, reflecting its status as a global economic and cultural phenomenon.

References:

- Deloitte (2024)

- FIFA (2024)

- Forbes (2024)

- CNN (2023)

- Deloitte (2023)

- New York Times (2023)

- Sports Business Journal (2023)

- Sports Pro Media (2022)

- NBC (2022)

- The Stadium Business (2021)

- Smart Pricer (2020)

- Reuters (2019)